Debt Collection in France

- Debt collection in France conducted locally.

- Risk-free. Pay only upon success.

- 9,5 % in commission.

![]() An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh!

An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh! ![]()

Efficient debt collection in France

Are you searching for a debt collection agency in France to recover a neglected invoice? Our French debt collection experts are eager to assist you. Read on to see how we can help you with debt collection in France.

Get paid from your French customer. Quick and easy.

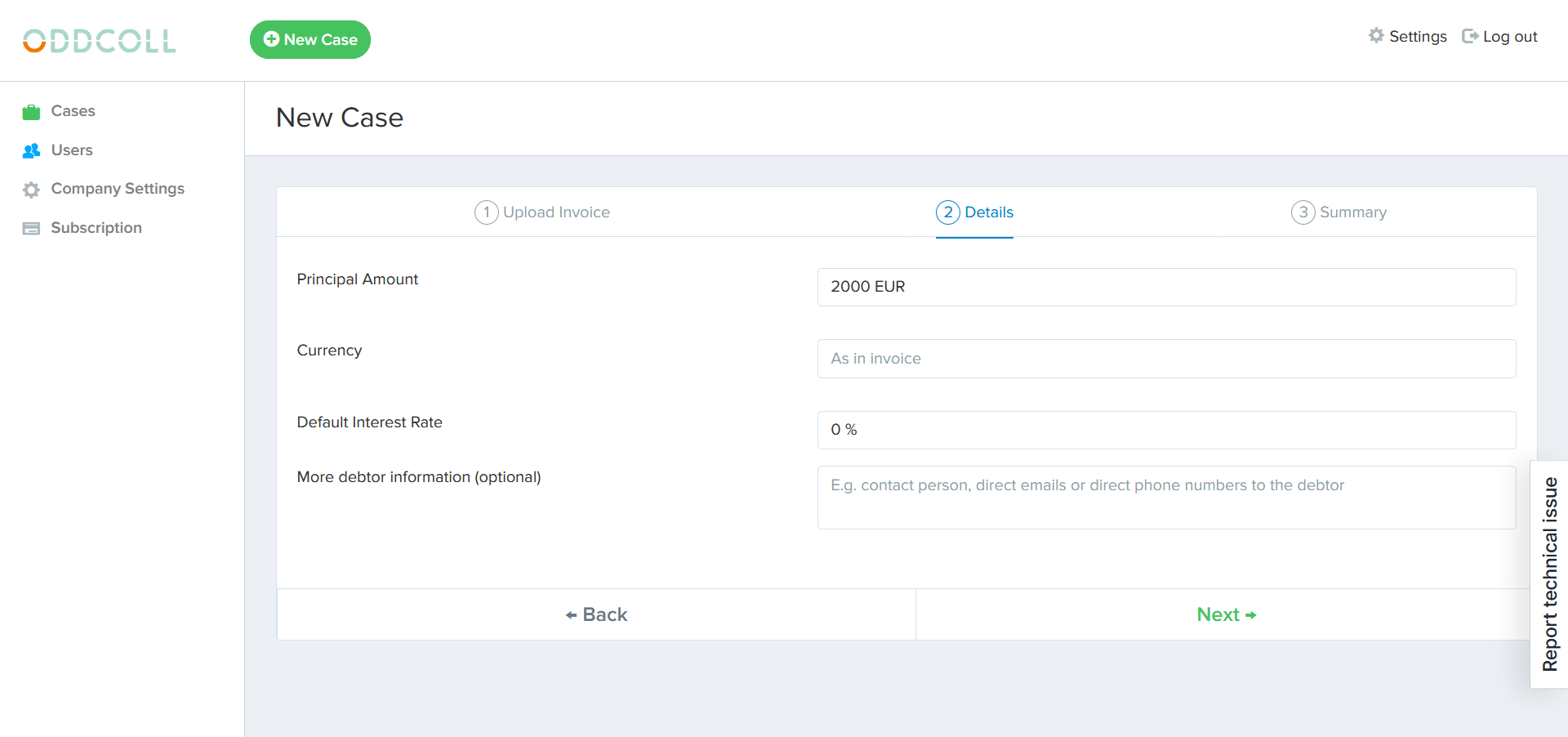

Upload your French claim.

Our debt collection agency in France starts the debt collection process.

After successful debt collection, the collected amount is transferred to you.

Some advantages of utilizing Oddcoll for debt collection in France.

Native French speaking debt collection experts.

Debt collection all throughout France.

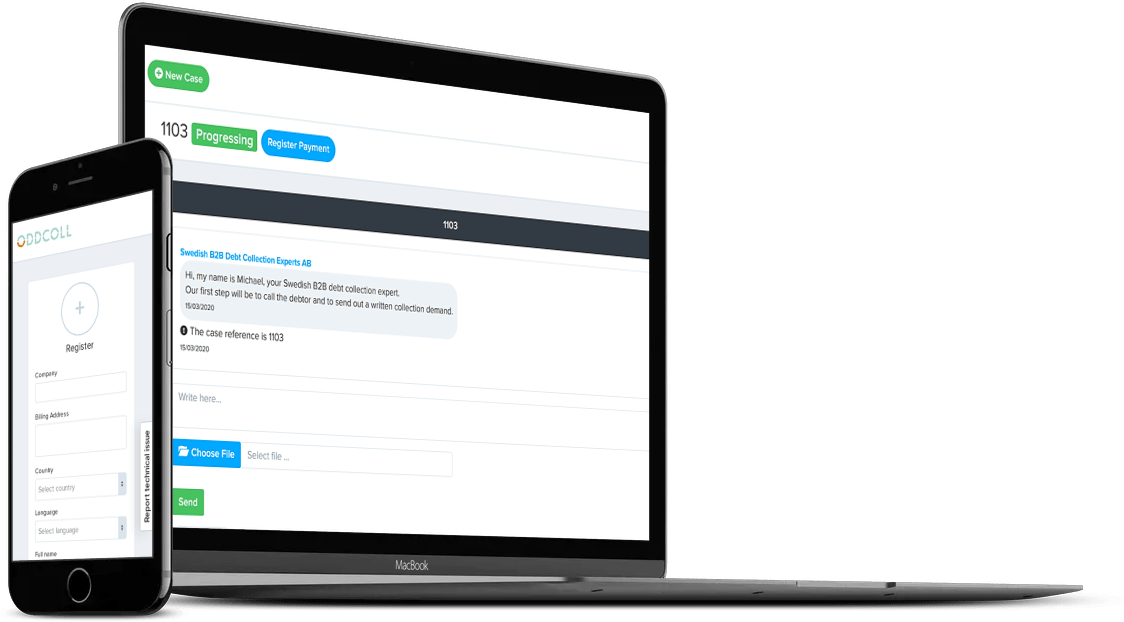

Smooth online processing of your case files

Risk-free. Meaning that you do not pay anything if you do not get paid yourself.

How we help you with debt recovery in France

Oddcoll hosts debt collection services for companies with sales in different nations. We have highly selected debt collection agencies and professional law firms worldwide and we make debt collection in France easy through our local French expertise. Implying that when you transfer a claim to us, our local France-based debt collection agency initiates the debt recovery against your French client.

To deal with our debt collection claims in France, we have hand-picked French debt collection firms. We currently work only with SSPCollect since they deliver the best results, and clients are exceptionally satisfied with their work.

Our debt collection agency in France.

Oddcolls partner in France is SSPCollect.

France is the world’s seventh largest economy and Europe’s third largest market, so obviously, France is an important trading partner for many companies selling their goods or services abroad. In a European comparison, the credit terms when selling to French companies are usually relatively long.

But how should you act when the invoice against your French client falls due? When your French customer does not pay, you need a professional partner in France to help you recover your debt. Someone who is an expert on the specific rules governing debt collection activities in France.

Our French expert and debt collection partner is located in Schiltgheim in Northeastern France. But of course they handle debt collection cases throughout the country as it is national French law that regulates debt collection and legal proceedings in France.

Could you briefly describe your company?

SSPCollect is a debt collection company specialized in B2B-claims since many years now.

What does your debt collection process look like? What do you do in the “amicable” debt collection phase in France to get paid.

In the “amicable” stage, we send letters, emails, registered letters and try to reach the debtor by phone several times.

When taking legal action, does the customer get back the costs they need to pay?

If we go legal, we always estimate the costs and of course ask the judge to sentence the debtor to pay them.

But we can never guarantee to refund those costs: it will all depend of the amount granted by the judge and the debtor’s solvency (if you are able to collect the costs on the debtor’s account etc..)

“Judicial” debt collection in France.

Our French debt collection agency will do everything in its power to get your debtor to pay the claim without the need for legal action. Sometimes, however, it may be needed. In that case, it is in France that legal action needs to be taken. But do not despair. We are also experts in this.

Which court do I go to with my french debt collection case?

Generally speaking, jurisdiction lies with the court of the respondent’s residence. The reason behind this is to give a level of insurance to respondents, as it will be simpler for them to defend themselves at the court closest to their home.

On the off chance that the respondent is an individual, in this manner, jurisdiction will lie with the court of the spot at which they are domiciled or inhabitant. For a legal entity, it is where it is set up, generally where its officially registered address is enlisted. Now and again, the primary address varies with the enlisted address. In such cases, it is conceivable to apply to the court in the area of the main establishment. For large organizations with a number of branches, the court applied to might be in the area of one of its branches.

The district courts judge the most frequent disputes. Generally speaking they judge all cases concerning sums up to €10 000. They additionally have jurisdiction to run on certain particular disputes (neglected lease, workplace level elections, attachment of profit, credit in matter of consumer or customer law). The local courts have jurisdiction for any remaining common questions that don’t fall under that of other courts.

To start a case, who precisely do I apply to?

To bring a legal case you need to apply to the local court office. French is the only official language acknowledged. A translator may help during the hearings, however an judge isn’t obliged to utilize one in the event that they know the language the party is talking.

A simplified legal procedure for uncontested debt collection claims:

In France there is a simplified legal procedure, suitable for debt collection in France.

The intention with this simplified legal process is that undisputed claims can be processed faster, faster and cheaper than ordinary legal proceedings.

This legal process is accessible for the recovery of all claims arising due to a contract and that is of a fixed sum. It is therefore a very suitable solution for uncontested debt collection cases in France.

Formal requirements:

The formal prerequisites enlist certain information that should be included in the application:

● Names and addresses of the parties to the case. (whether private persons or companies.)

● An exact figure of the sum claimed, with proper breakdown of the different components of the claim, and their basis.

The application should be joined by supporting records showing the legitimacy of the case (invoices, agreement of sale, lease contract, credit agreement,statements, and so on) The principles of ordinary law administering civil procedure are applicable here.

What happens if the debtor disputes the claim?

The defaulter has a time of one month wherein to object, either at the clerk’s office of the court which gave the order or by an enlisted letter routed to the same clerk’s office.

The filing of a objection to the claim means that ordinary legal proceedings are initiated and all the concerned parties are gathered for a hearing by the judicial clerk.

What happens if the debtor does not dispute the claim?

Following a time of one month following notice of payment has passed, the creditor applies to the clerk’s office which passed the order, requesting that they should issue an order for enforcement. There are no conventional requisites for this application (the creditor may essentially say something or send a letter by common post).

Enforcement of claims in France.

What happens if you go to court, the court decides you are right and issues a positive verdict for you. But your French customer still does not pay his debt? It then becomes relevant to apply for enforcement. The French authorities will then help you to get paid.

In other words, the French authorities are forcing the debtor to pay you. (Assuming there is some money/assets to pay with.) In this sense, this can be seen as the last step for debt collection in France.

This is carried out by special Enforcement Officers.

Initially, the creditor pays the fee to start an enforcement. But the cost is later added to the debtor’s debt.

For this procedure there is no requirement to be represented by a lawyer.

Insolvency proceedings in France.

Insolvency proceedings are a part of the French debt collection process that is somewhat separate from the other elements.

These are situations where a debtor may not necessarily have defaulted on an invoice. But rather that they actually do not have sufficient funds to pay their creditors.

In France, there are a few different insolvency proceedings that aim to achieve different goals. There are.

– rescue measures (procédure de sauvegarde)

– company reorganisation (procédure de redressement judiciaire)

– liquidation (procédure de liquidation judiciaire).

Rescue procedures and company reorganisations aim to save the business and keep it going. In such proceedings, a debtor may continue to dispose of his assets, but a liquidator may be appointed by the court to help the debtor to restore his solvency.

In a liquidation, however, the company will cease to exist and a liquidator will take over the running of the company to ensure that all creditors are treated fairly.

“No win no fee” debt collection:

At Oddcoll, we apply the “no win no fee” pricing model. This means that you can start a case with us completely safely and risk-free. You only pay when you yourself have received payment from your French customer. It also means that we work hard for results with the same incentives as you to get a payment. In this way, we sit in the same boat with the same goal.

We can help you with debt collection in France. Our debt collection professionals are eager to assist you settle your case of debt recovery in France. Don’t hesitate to contact us for more information. Or upload your invoice immediately. Our experts will promptly begin recovering your debt.

See how easy it is to get started with your case!