Debt Collection Germany

- Debt collection Germany – conducted locally.

- Risk-free. Pay only upon success.

- 9,5 % in commission.

![]() An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh!

An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh! ![]()

Effective debt recovery in Germany

Are you in need of debt collection services in Germany? The best choice for you would then be to contract a debt collection firm in Germany. We have expertise and understanding of German debt collection legislation with central debt collection experts in Germany. Communication is no obstacle for us when we talk to your debtor in his native tongue, helping us to effectively settle your debt recovery in Germany. Read on to see how quickly Oddcoll can help you.

Get paid for your German invoices in three easy steps

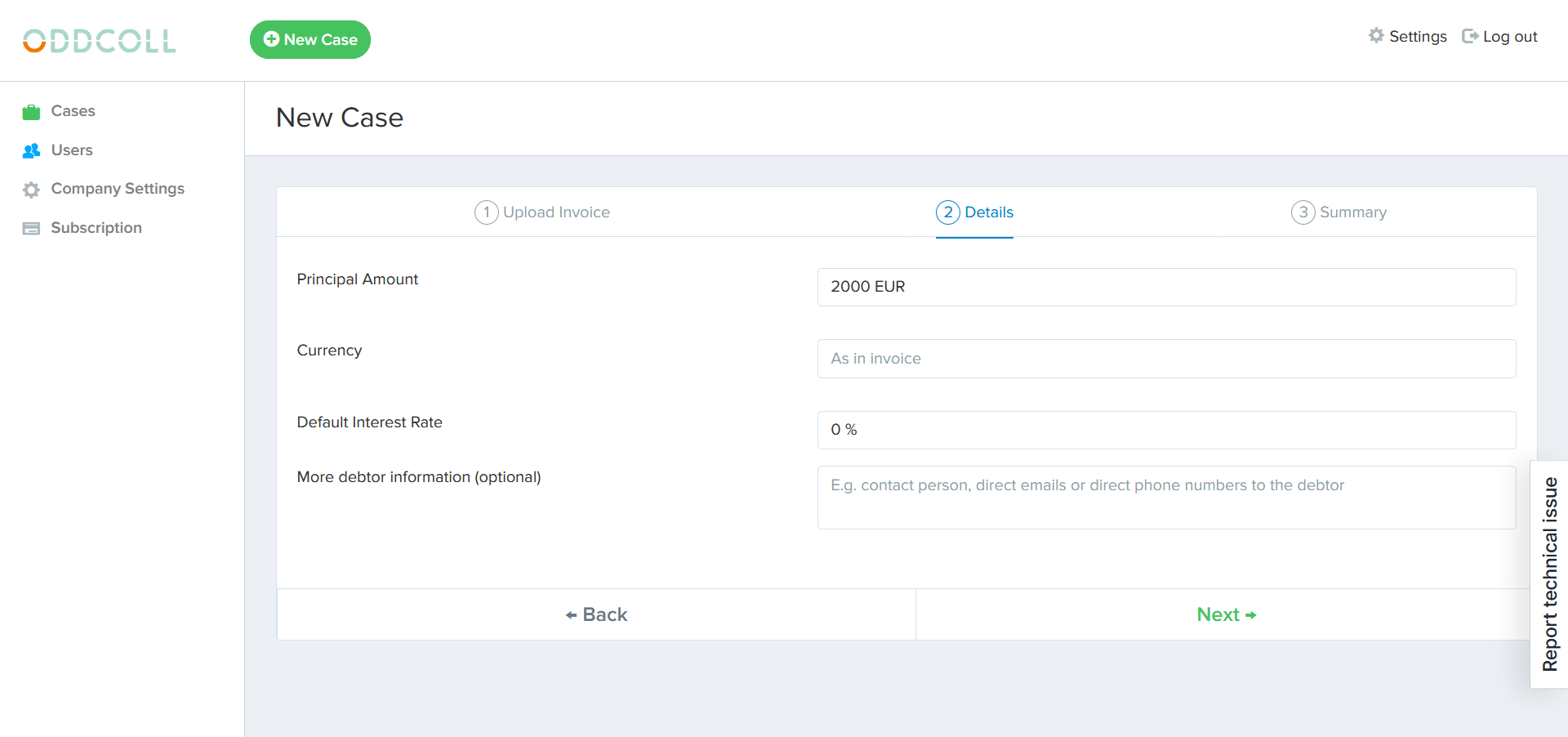

Transfer your German invoice to our web portal to start your debt recovery case.

Our debt collection agency in Germany starts actions against your debtor to collect the debt.

After successful collection, the money is transferred to you.

The benefits of using Oddcoll for debt collection in Germany.

A native team for debt collection Germany.

The whole debt collection procedure – from payment reminder to court proceedings.

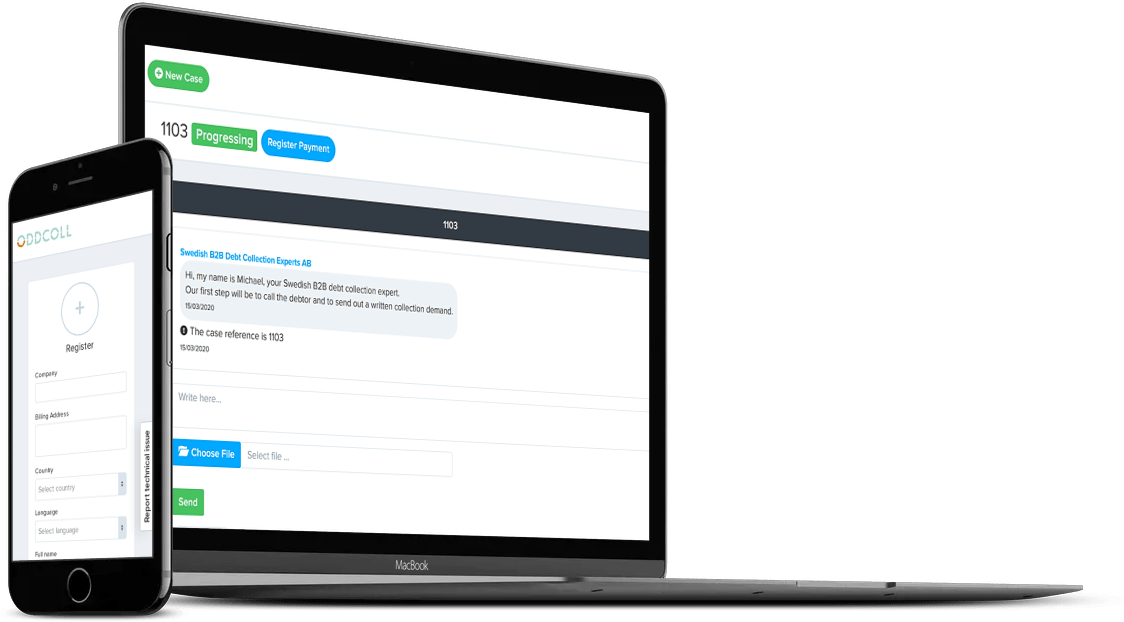

24/7 access to our online portal.

Debt collection in Berlin

Understanding the unique financial landscape of Germany, such as Berlin and other major cities, local expertise to handle your debt recovery efficiently. Our dedicated team and intuitive platform ensure a smooth process, helping you recover debts swiftly while keeping you well-informed every step of the way. We prioritize maintaining positive relationships and protecting your reputation throughout the recovery process. With our comprehensive support, you can focus on your core business while we manage the complexities of debt collection.

How our Service helps companies get paid for their debts.

Oddcoll offers debt collection services for companies with sales to other countries. We have hand-picked debt collection agencies and law firms worldwide and we make debt collection in Germany effective through our native expertise. We cover the debt collection procedure in all the european countries. We specialise in debt collection against companies and not against private individuals.

To manage our debt collection cases against debtors in Germany, we have hand-picked German debt recovery firms. We now only work with Germania Inkasso-Dienst GmbH since they offer the service with the highest performance rate, and customers are very pleased with their work.

All you need to know about international debt collection in 60 sec.

Our Debt Collection Agency in Germany.

![]()

When you have a claim against a debtor in Germany, you are in a difficult position as a creditor.

Recovering a German claim from another country is complex. Different laws, customs, and cultures make the debt collection procedure a very hard and time-consuming task.

Through Oddcoll, you´ll use a German Debt Collection Agency that recovers your debts from day one.

Our partner in Germany, Germania Inkasso-Dienst GmbH, starts the recovery when you upload your debts. And your claim will be handled as a domestic debt collection case in Germany, meaning your debts will be recovered more effectively.

Information about debt collection in Germany.

Below, we will go through how the debt collection process works in Germany when you want to recover an outstanding amount.

From the moment a debt collection agency in Germany tries to collect the debts in the voluntary collection stage in Germany. To legal action through court proceedings and enforcement proceedings.

“Amicable” debt collection in Germany.

“Amicable” debt collection in Germany.

The debt collection process in Germany against the debtor starts out-of-court.

The German debt collection agency, on behalf of the Creditor, tries to get the debtor to pay without having to take any legal action.

Instead, it sends collection letters, calls, and contacts the debtor in other ways. It also tries to get an idea of the debtor’s financial situation at this stage.

What makes a German debt collection agency successful at this stage is the ability to negotiate and put pressure on the debtor.

The most important law for debt collection in Germany is the law on legal services “Rechtsdienstleistungsgesetz (RDG).”

Authorisation to collect claims in favour of a Creditor against its debtor.

For a debt collection agency to take debt collection action in Germany against German debtors, it must be authorised by the authorities. It is required that the debt collection agency adheres to the legal rules on debt collection in terms of how debtors are treated.

Here you can find the registered and approved German debt collection agencies.

Applicants wishing to carry out debt collection activities in Germany must demonstrate specific expertise in the legal areas relevant to debt collection. Such as civil law, commercial, securities and company law, civil procedure law, enforcement and insolvency law. In addition, personal suitability and reliability must be demonstrated.

The authorities may impose conditions on a debt collection agency or prohibit its activities in whole or in part. In particular, if the company seriously or persistently breaches its obligations.

The authorisation of a debt collection agency may also be withdrawn. For example, if dubious collection methods are persistently used.

Judicial debt collection in Germany

Judicial debt collection in Germany

Unfortunately, sometimes it may be necessary to take legal action against a German debtor as he does not pay despite pressure in the amicable stage of debt recovery in Germany. Our German representative can easily help a Creditor with this.

Which court in Germany should you turn to for your unpaid debt collection claims?

1. If the amount of the German debt collection case does not exceed EUR 5 000 and the regional court does not have special authority, the district courts usually have the right to try the cases in civil matters.

2. In view to all legal cases which are not referred to local courts, the regional courts have authority at first step. There are mainly situations where the contested amount is greater than EUR 5 000.

In Germany, in the Code of Civil Procedure (Zivilprozessordnung, ZPO) (Sections 12-18), the basic rules of jurisdiction is that local jurisdiction is determined by the location where the debtor resides. In the case of a legal organization, the registration office shall determine the territorial jurisdiction (Section 17 ZPO).

To initiate legal proceedings as a Creditor, who exactly do I apply to:

An argument must usually be made with the court that has jurisdiction in writing. If, however, the district court has authority over the case, the lawsuit can be reported orally at the office of the court (Geschäftsstelle des Amtsgerichts). The lawsuit can be filed at any local court’s office. The office shall without delay transfet the lawsuit to the appropriate court. German is the tongue of the tribunals. So it is appropriate to file the charge in German.

Will I have to pay any money to the court for my claim?

For cases before the courts concerned with civil and economic matters, court expenses are paid. Such payments are the tribunal’s fees and expenses. Following the submission of the lawsuit, the court charges an advance deposit on account of the court expenses (Gerichtskostenvorschuss) corresponding to the sum of the statutory court fees. Generally, once the party taking the suit has paid the advance payment of legal expenses on account, the claim will be served upon the opposition party. The same refers to the process for a payment order.

The existence of an “order for payment” in Germany.

For unopposed debt collection cases against German debtors, there is special legal proceedings. In general, this method can be used if the demand is for the payment of a fixed amount of money in euros.

But it cannot be used on the following occasions:

• Claims resulting from a consumer credit arrangement with an interest rate of greater than 12% above the base rate,

• claims based on the results of commitments that are yet to be fulfilled,

• where a published notice will have to be placed on the request for payment and the address of the respondent is undisclosed.

There is no upper limit which can be asserted on the amount. The creditor’s use of the order for the payment is voluntary. The claimant can choose between this process or an ordinary trial.

The local court (Amtsgericht) with ordinary jurisdiction for the claimant has exclusive jurisdiction for the order for payment proceedings. This is decided by the place of residence of the person or, in the case of a legal body, by the registered office of that person. Many German federal states, however, have set up central courts for cases of reimbursement orders (Mahngerichte) (such as the local court of “Wedding in Berlin).

Where the claimant does not have an ordinary position of jurisdiction in Germany, the sole jurisdiction of the central court “Wedding” in Berlin shall apply. If the respondent does not have an ordinary position of jurisdiction in Germany, the jurisdiction of the local court, irrespective of the difference of jurisdiction by subject-matter, is to have jurisdiction over the case (generally, local courts have jurisdiction of up to EUR 5 000 only). Central payment order courts of certain federal states may also be present here.

The court must, on request, issue an order for compliance. The request cannot be submitted until the expiry of the period provided for the objection; it must contain a clarification of what, if any, payments were made in respect of the order for payment. If part payments have been made, the claimant is allowed to decrease the amount demanded accordingly.

If the respondent contests the claim in time, no execution title can be given. However, the case will not automatically be dealt with by ordinary litigation afterwards, as this includes an express request for ordinary hearings, which can be made in an order for payment process from either the claimant or the respondent. As soon as the applicant becomes aware of the objection, the applicant may opt to make such a submission, and may even apply it as a precautionary measure to the payment order itself.

Enforcement proceedings in Germany.

If the debtor has not paid, the creditor must pursue enforcement as the last step. The creditor must have a judgment from the ordinary court proceedings or an enforcement order from the dunning procedure.

The debtor or the creditor can file the application for enforcement.

Easily create your case for debt collection Germany by simply uploading the invoice through our online form.

This is how our debt collection service works.

Do you need help with debt recovery in Germany? Our German debt collection experts will be glad to assist you settle the issue. For more details, please feel free to get in touch with us. Don’t you want to wait any longer for your German debtor to pay you? Then quickly upload your invoice to our portal. Our experts would then get to work immediately.

See how easy it is to get started with your case!