Debt Collection in the Czech Republic

- Debt collection in the Czech Republic, conducted locally.

- Risk-free. Pay only upon success.

- 9,5 % in commission.

![]() An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh!

An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh! ![]()

Do you need help with debt collection in the Czech Republic?

When collecting a Czech invoice, Czech laws and regulations apply. Thus, a Czech debt collection expert on site in the Czech Republic will need to assist you for maximum success. Read on to see how Oddcoll can help you.

Get paid for your Czech claims in three steps.

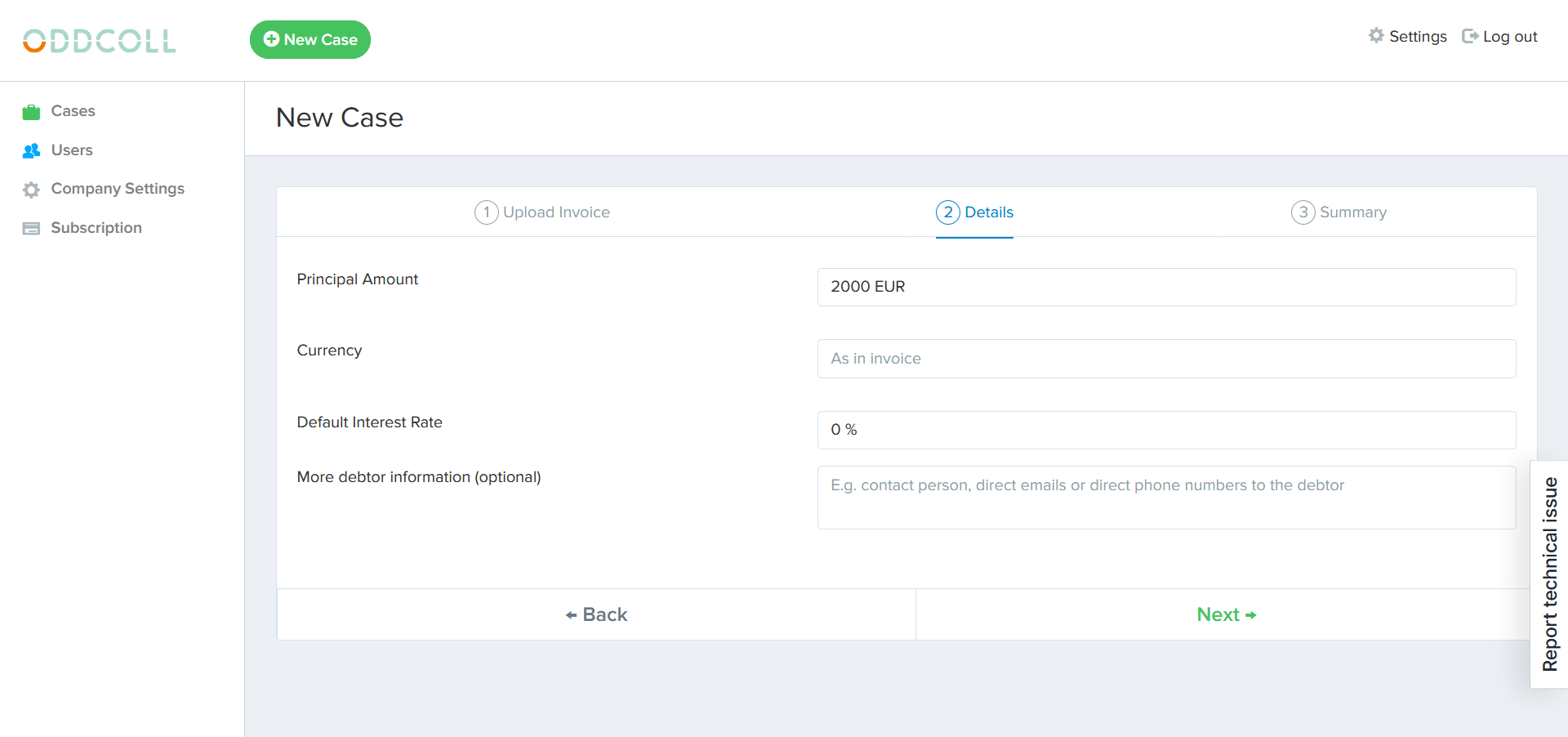

Create debt collection cases against your Czech customers on our debt collection platform.

Our local debt collection agency in the Czech Republic will start working on your cases immediately.

Once your Czech debtor has paid, the money is transferred directly to you.

A few reasons to use Oddcoll for debt collection in the Czech Republic.

Our debt collection agency speaks Czech with the debtors.

We are on the ground in the Czech Republic and effective debt collection must be done locally in the debtor’s country.

Our debt collection in the Czech Republic is completely risk-free and you only pay if the debtor pays the debt.

Get paid quickly and easily without hassle.

Getting paid from Czech customers can be a hassle when you’re in another country. The problem with international debt collection is that it is generally difficult to get debtors in other countries to pay. This is because national rules apply to debt collection and court proceedings.

To make it easy for you to get paid from your customers abroad, we have created a debt collection platform specifically designed for companies that sell to an international customer base. We have brought together the best local debt collection agencies and law firms around the world.

This means that if you choose to use us for debt collection in the Czech Republic, our Czech debt collection agency will immediately begin collection efforts in the Czech Republic to get your debtor to pay.

Our debt collection agency in the Czech Republic.

Based on the fact that they deliver a very high recovery rate in their debt collection cases, as well as the customer satisfaction of previous clients, we cooperate in the Czech Republic with the debt collection company Crediteform S.R.O.

” Judicial” debt collection in the Czech Republic.

Which court should I turn to for my Czech debt collection case?

When a creditor has a claim against a debtor in the Czech Republic, the basic rule is that the creditor should apply to the district court where the debtor is domiciled. If the debtor is a natural person, “domicile” is the place where the debtor has his or her residence. If the debtor is a natural person carrying on a business, the place of “domicile” is the place where the business is carried on. And finally, if the debtor is a legal person (organisation/company), “domicile” is the place where the legal person has its registered office.

The main rule for civil disputes is that the district courts are the first instance to which a creditor should turn. There are some exceptions for specific types of disputes where some specialist knowledge is needed by the courts.

It is not necessary to be represented by a lawyer in the Czech Republic when taking a case to court.

A lawsuit must be sent to the court that has the right to hear the case. The application does not have to be in Czech; a creditor from another country can use his or her own language. However, in order not to delay these cases, it is recommended that a translation into Czech be attached for these situations.

Taking your debt collection cases to court in the Czech Republic involves certain costs. More information on these costs can be found in Act No 549/1991 on court fees. If these costs are not paid, the case will never be heard.

Procedure for “Order for Payment” in the Czech Republic.

In the Czech Republic, there are two payment order procedures that are suitable for judicial debt collection in the Czech Republic. These are

- the order for payment procedure and

- the electronic order for payment procedure.

The ordinary order for payment procedure is a procedure that the court decides whether to initiate. It is not the creditor himself who actively applies for it. If the court does not consider it appropriate to issue an order for payment in the individual case, it decides instead to hold ordinary civil proceedings with a hearing, in which both parties are heard.

In order for the court to choose to proceed with an order for payment instead of calling for a main hearing in a particular case, the following preconditions must be met; The claim must be for a certain amount of money. In addition, the application must meet the other general requirements for a writ of summons. For example, the application must contain information on the parties and about the legal basis for the claim. Written evidence demonstrating the legal relationship must also be sent with the application.

If the court does not consider it appropriate to issue an order for payment, the case will continue to be dealt with under the rules of ordinary civil proceedings.

An electronic order for payment procedure is a procedure that a creditor must actively choose to apply for.

There is an upper limit of CZK 1 000 000 for the use of this procedure.

The application is made electronically and signed electronically. Evidence is also submitted electronically with the application.

The information required is the same as in a normal summons. If the court finds that the application is incomplete, it will be rejected and the case will not be heard.

What happens in the process of judicial debt collection in the Czech Republic if the debtor chooses to contest his/her payment obligation after an order for payment has been issued? A debtor has 15 days to consider the claim. If a substantive objection is made, the order for payment process ends and the case is instead transferred to the ordinary litigation procedure.

If no objection is made within 15 days, the order for payment acquires the same legal status as a judgment, i.e. it can be enforced against the debtor in an enforcement procedure.

Enforcement of claims in the Czech Republic.

When a creditor reaches a point in the debt collection process in the Czech Republic where a judgment has been obtained through the ordinary civil procedure or a writ of execution through an order for payment procedure, this usually leads to the debtor complying with this and paying his debt.

However, this is not always the case. There are therefore situations where debtors continue to default on their payments.

For these cases, the next step in debt collection in the Czech Republic is to apply for enforcement of the debt. This means that a creditor turns to the public authority in the Czech Republic for help in collecting payment. The authorities then help the creditor to obtain payment by compulsion.

This procedure is regulated in §§ 251-351a of Act No 99/1963, the Civil Procedure Act.

The procedure starts when the creditor applies for enforcement because the debtor continues to fail to pay.

Insolvency proceedings in the Czech Republic.

Finally, we will go through one last part of the Czech debt collection process which may occasionally arise when the debtor is not in a position to pay all his debts. I am talking about Czech insolvency proceedings. These can be applied to both private individuals and companies, but there are different procedures which can have slightly different purposes and affect these groups slightly differently.

Insolvency proceedings can be initiated if;

- There are several creditors,

- If there are claims with due dates more than 30 days in the past, and,

- If the debtor has no financial means to pay these claims.

The insolvency proceedings that may be involved are;

Bankruptcy: This procedure is applied to both individuals and companies. This is the last resort and is only used when reconstruction or debt restructuring is deemed futile. The debtor’s assets are consolidated and distributed to the creditors. The company then ceases to exist.

Restructuring (reorganizace): This procedure is only used against traders and is used as a tool to try to resolve the default situation in a way that allows the trader to continue operating. In concrete terms, this means that a restructuring plan is drawn up in consultation with the creditors, in which the debtor’s claims are written down so that they are able to meet their obligations.

Debt restructuring (oddlužení): Used only against private individuals. Aimed at giving highly indebted people a chance for a fresh start by drawing up a payment plan for the existing debts based on the debtor’s financial circumstances.

We are here if you need help with debt collection in the Czech Republic. Contact us if you have any questions or start your Czech debt collection case easily by creating an account and uploading your unpaid claims.

See how easy it is to get started with your case!