Debt collection in the United States

- Debt collection performed locally in the US by domestic expertise.

- Risk-free. Pay only upon our success.

- 19,5 % in commission.

![]() An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh!

An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh! ![]()

Effective debt collection in the US.

Do you have a US invoice that you have not been paid for? We can help you with debt collection in the US. Quickly and easily. Read on to see how!

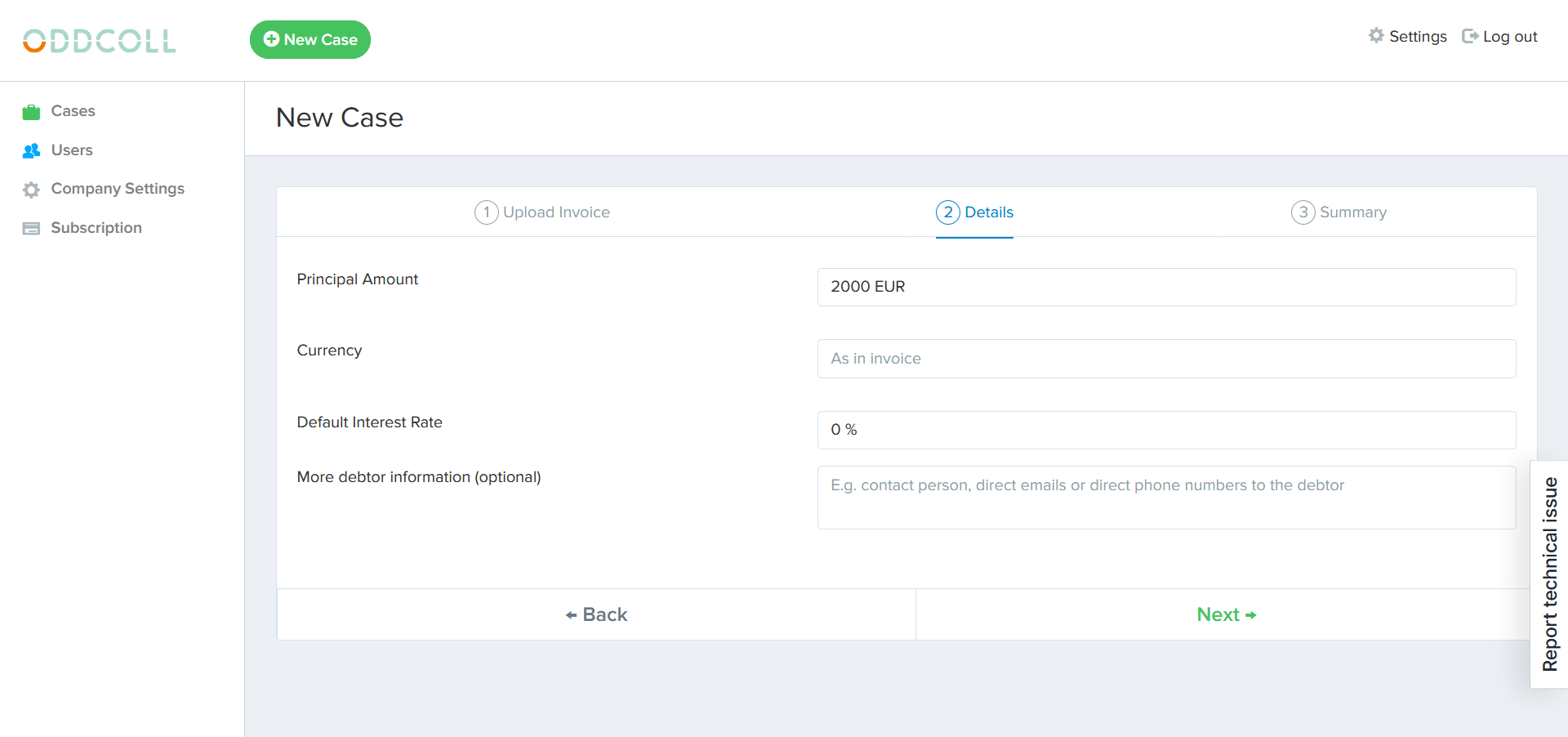

Here’s how it works. 3 steps.

Get started with your debt collection case by simply uploading your invoice against your US customer on our debt collection platform.

Our local collection agency in the US will start working to get your debtor to pay.

Once payment is made, the money is transferred directly to you.

Get paid from your customers in the US.

We cover the whole USA.

Local collection by a US collection agency.

Get started quickly and manage your cases easily on our web portal.

Risk-free debt collection.

How we help you with debt collection in the US.

Oddcoll is a global debt collection platform that easily helps you get paid no matter where your debtors are in the world. We’ve brought together the best national debt collection agencies and law firms around the world, which means your invoices are always collected locally where your debtors are located.

Get started with debt collection in the US easily by simply creating an account and uploading your unpaid invoice. Then our US debt collection agency will immediately begin the collection process.

Our debt collection agency in the USA.

In the US, we are partners with the american debt collection agency Global Debt Solutions Inc.

They will collect your invoices locally in the US once you have uploaded the invoices on the Oddcoll platform.

Could you describe your company?

Global Debt Solutions, Inc. is an International debt collection agency established in July 2000. Our primary goal is to provide a quality service to our clients by keeping them informed and collecting their receivables and bad debt as quickly as possible.

Can you give us an overview of the collection process in the United States?

The United States has established many laws regarding the methods of collecting. We have a system here at Global Debt Solutions, Inc., that includes increasing pressure on the debtor over a short period of time.

What actions are you taking in the amicable stage of debt collection?

Amicable actions include pressuring the debtor with telephone calls, emails, and letters to the debtors.

How does it work in the United States when you need to take legal action?

In the United States, claims under $15,000.00 do not warrant legal action which is established by the attorneys here as they work on contingency also. If we recommend filing legal action against a debtor, the filing costs are paid by the creditor. The costs differ from state to state and we also advise our client/creditors what those costs are before any action is taken.

If you are taking legal actions in a case and you win in court, can the costs for legal actions that the client has paid for be added to the debt?

The costs for legal action in the event the creditor is awarded a Judgment for the amount due, is rarely awarded by any Court in the U.S.

Debt collection in the United States – An overview.

Historically, debtors, in the US, were kept on a tight leash by their creditors. Upon failing to repay their debt, debtors and their families could be forced into debt slaver. This lasted until the creditor had successfully recouped his losses through the debtor’s family’s service. Unpaid debts could even be passed through generations if the debtor were to die without repaying. Debtor’s prisons were prisons specifically used to hold debtors until their families could repay their debts. When these were abolished, creditors came to rely heavily on foreclosure. Execution is when creditors seize assets with the help of the authorities.

Today, most of these cruel practices are illegal and the rest are heavily regulated by authorities. Laws regarding debtor’s rights have been established and are upheld by state- and federal governments in the United States. Each state has different laws regarding debtors’ protection that may or may not be stricter than the federal laws. In each state, the stricter laws are applicable, whether that is the state law or federal law.

There are different types of debt collection services in the US. When the collection activity is handled by a direct department of the creditor, it is called first-party debt collection. This is because the party performing the collection action is itself a party to the case. They are the creditor’s first stop for collecting debts – or at least those creditors who have a debt collection department in their company. They try to collect the debt for a certain period of time and if they are unsuccessful, they usually hand it over to a third-party debt collection agency that has more specialised knowledge of how to effectively collect debts in the US.

A “third-party” debt collection agency in the US is one which was not a party to the original the debt relationship. Companies resort to these agencies when they themselves have failed to collect payments and some time has passed. They assign cases to a debt collection agency of their choosing. In the US this is usually on a contingency-fee basis. This means that no initial payment will be made by the creditor to the debt collection agency. However, the collection agency is entitled to a percentage of the debt that it is successful in recovering. This percentage is agreed upon by both parties and depends on the type and age of the debt.

In the US, these collection agencies are subject to the federal “Fair Debt Collection Practices Act of 1977”. According to this act, phone contact to a debtor can only be made between 8 am and 9 pm. If the debtor is represented by an attorney, the collection agency may not contact the debtor at all. If a written request for the proof of a debt is made, the creditor has to mail the verification to the debtor within thirty days and no contact by the collection agency to the debtor is to be made in this period.

Additionally, the collection agency may not communicate anything regarding the debt to a third party like family members or neighbors. It is however, allowed to contact third parties in order to inquire about the whereabouts of the debtor or to get contact information if the collection agency is unable to locate the debtor. Most importantly, the collectors must identify themselves by giving their name, their agency’s name and stating that they are a debt collector in every communication. They must also give the name and address of the creditor and notify the debtor of their right to dispute the debt under Section 809.

The statute of limitations are rules that sets the longest period of time after an event during which legal proceedings can be initiated. Debts can become time-barred if the debtor does not repay within this period. In order to circumvent the limitation period, debt collectors sometimes take steps to break and reset the limitation period.

Companies may also sell their debts to a third-party company known as a debt buyer for a percentage of the original value of the debt. This is usually done as a last resort when the creditor feels that they do not have any hope of collecting the debt. Selling the debt allows them to minimize their losses as much as possible, get immediate – although reduced – revenue, and move on. This also eliminates the duty of debt collection and the risks that come with it by passing the responsibility to the buyer.

The buyer, in turn, continues to try to get the debtor to pay. This may take a long time, but the business model is that the debtor may eventually regain some ability to pay and the buyer may therefore recover more than they bought the receivables for.

If you need help with debt collection in the US, Oddcoll can help you quickly and efficiently.

See how easy it is to get started with your case!