Debt Collection in Sweden

- Debt collection in Sweden conducted locally.

- Risk-free. Pay only upon success.

- 9,5 % in commission.

![]() An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh!

An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh! ![]()

Debt collection in Sweden against your Swedish clients

Do you have a Swedish customer who has not yet paid your invoice even though it is due? This means that the collection process will be governed by Swedish rules and laws. Debt collection in Sweden is often complicated because of this. Our experts have the expertise, practice, and tools to recover your Swedish claim. Read on to see how we can help you.

How we can assist you in get paid!

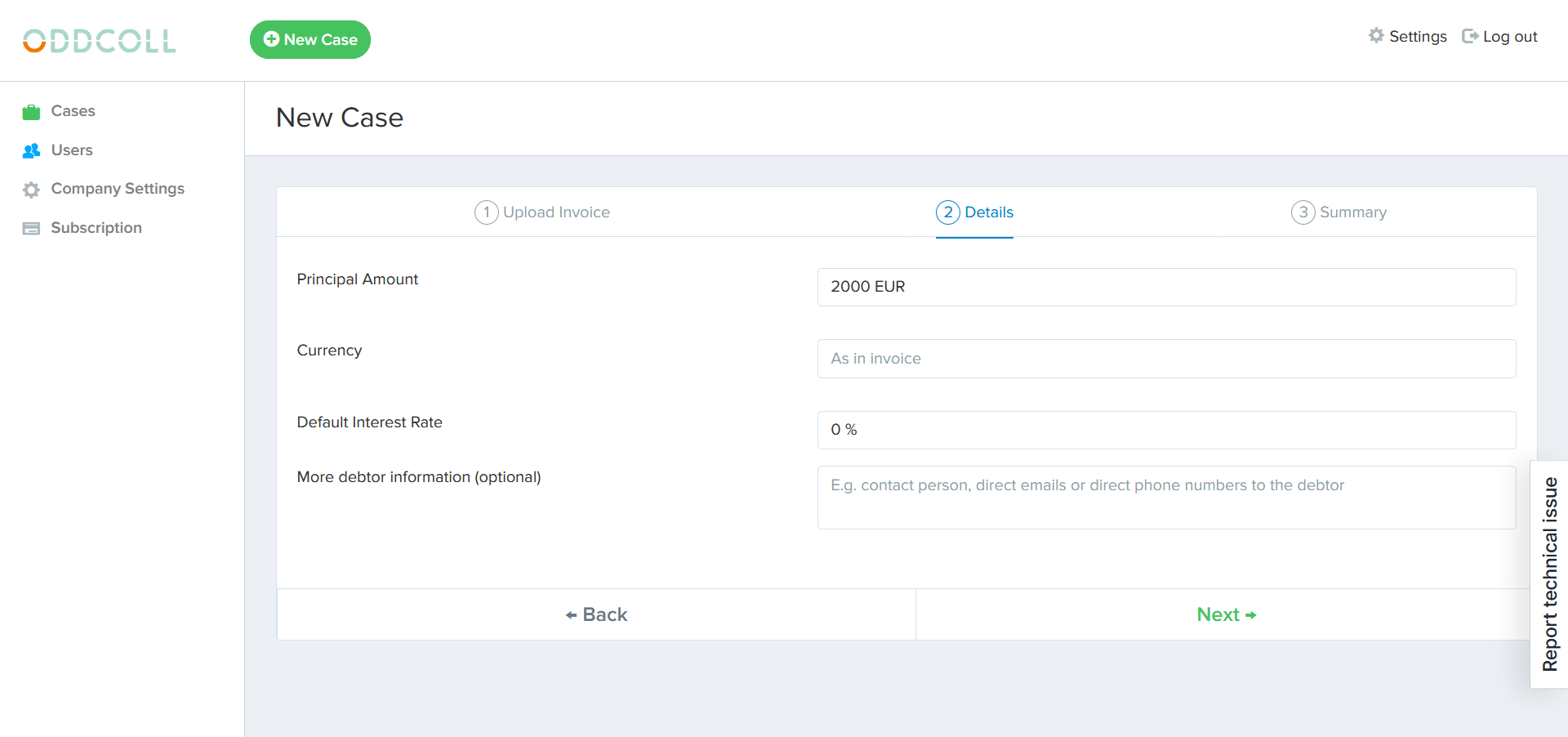

Upload your Swedish invoice!

Our national debt collection agency in Sweden start to collect the invoice.

The collected amount is transferred to your account.

The best chances to collect your Swedish invoices!

Local Debt Collector on site in Sweden.

Against debtors throughout Sweden.

Specialists in Swedish conditions and regulations.

A debt collection service specialized in cross-border claims.

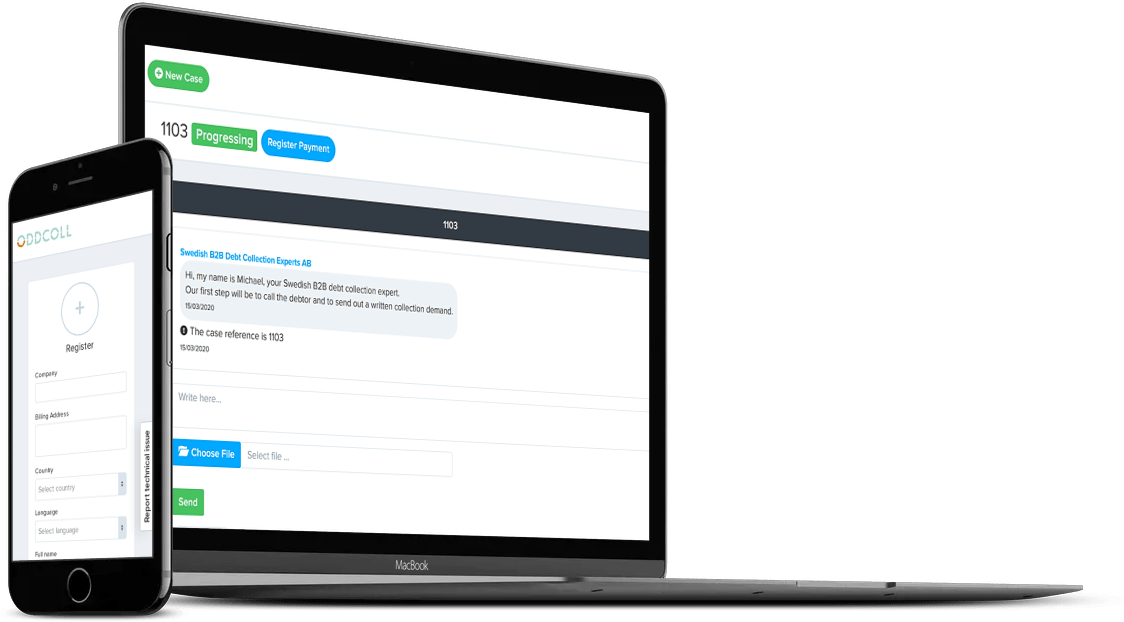

Oddcoll is a debt collection tool designed for international businesses like yours. We make debt collection in Sweden simple for companies from other countries than Sweden.

We’ve built a platform with the best debt collection agencies and legal firms worldwide to support foreign companies get compensated by their customers in other countries.

The rates have previously been fixed, and you only have to pay after the claim has been collected.

Our local debt collection agency located in Sweden who will directly initiate collection actions on the spot:

We are pleased to introduce Observa Inkasso & Juridik as our and debt collection agency in Sweden. They will immediately start collection actions in Sweden when you start a case.

Swedish Debt Collection Rules

The Swedish “Debt Collection Act” governs debt collection operations.

What is debt collection in the sense of Swedish law?

The recovery of Swedish receivables through debt collection actions.

What then is a debt collection action?

Debt collecting actions in Sweden refers to any action that puts a pressure on the debtor. Such as a letter with a debt collection demand or an appeal for a payment order. The normal debt collection action is to “threaten” the debtor that non-payment means that legal action will be taken. Which also means higher costs for the debtor.

Good debt recovery practice.

As a general basic rule, swedish debt collection activities must be conducted in accordance with good debt collection practice. The debtor may not be caused unnecessary damage or inconvenience or be subjected to undue pressure or other improper debt collection measure.

Permission to conduct debt collection activities.

An approval from the authority is necessary to perform debt collection operations, as per section 2 of the Debt Collection Act.

Before any debt collection actions are taken.

According to good debt collection practice, an invoice must be overdue for before any action can be taken. Before debt collection steps are taken, the claimant must have been informed of the payment demand by an invoice or another means.

Deadlines.

The debt recovery petition shall specify a fair period for the delinquent to pay willingly or respond to the claim. The debt collection claim’s period may not be less than eight days from the date the complaint is submitted.

Contact with the debtor.

A debt collection agency must respond to the debtor’s questions regarding the claim and the legal grounds for it as soon as possible.

All details given to the debtor, whether written or spoken, should be accurate, simple, and complete.

The debtor should be regarded with respect and dignity.

“Judicial” debt collection in Sweden.

Applying for an order for payment.

If a Swedish debtor does not pay despite debt collection actions, there is a summary legal process. It is called “order for payment” (Betalningsföreläggande.)

An application for an order for payment must relate to a debtor’s obligation to pay a specific debt for a specified amount. The claim must be overdue. The procedure can be used regardless of the size of a claim.

It is not mandatory to choose to submit an application for a payment order. Instead, you can submit a writ of summons for the ordinary court proceedings.

A written and signed application for a payment order is needed. The complainant must mention the basis for the debt in the application, the sum of the claim and the due date. The parties must also be identified in the application.

When filing for a payment order, you have the right to make your own argument and are not required to have any representation or lawyers. But the application must be sufficiently detailed to enable the debtor to understand the claim and to decide whether to contest it.

No further legal assessment is made by a judge in the process of the payment order. Should the debtor oppose the claim, the case is transferred to an ordinary court hearing in the District Court.

Statement of opposition: The order specifies the time frame for contesting the claim. Normally, the period limit is set at ten days from the day the order was given.

Effect of statement of opposition: If the debtor objects to the payment order, the Creditor will be notified as soon as possible. If the Creditor wants to pursue the lawsuit further, he or she can ask for the case to be transferred to the district court (tingsrätt).

Effect of lack of a statement of opposition: The Enforcement Authority may make a ruling if the defendant does not contest the application within the time limit. The ruling will then be enforcable.

The “ordinary” legal procedure.

If you as a creditor do not wish to use the order for payment, there is always the possibility of using the usual court proceedings for civil litigation.

The same also applies if the debtor objects to the claim. Then the debtor needs to be sued in court.

Disputes in civil law are normally heard by a general court. The case must be brought before a district court (‘tingsrätt’) that has jurisdiction. That is, where the company has its headquarters.

Enforcement of verdicts in Sweden.

When an administrative authority enforces a court-ordered obligation, that is known as enforcement. The term “enforcement” refers to the process of enforcing a duty.

The Swedish Enforcement Service is in charge of enforcement (Kronofogdemyndigheten). The overarching liability for the activity is borne by a senior enforcement officer, although the direct enforcement is normally done by other personnel (enforcement administrators).

A verdict or judgment is required for enforcement to take place. Creditors can obtain this through the usual legal proceedings in the district court, or alternatively through the Order for Payment procedure.

It costs money to apply for enforcement. The cost falls on the defendant. However, the creditor may have to bear the costs at an application stage and if the debtor does not have assets that cover the application fee.

Insolvency proceedings in Sweden.

The Bankruptcy Law in Sweden regulates dissolution, reorganization of businesses, and debt reduction.

Bankruptcy (konkurs) is a type of regulation for companies in insolvency, in which the creditors collectively take the debtor’s entire wealth to cover their individual claims. The funds are pooled into a bankruptcy estate (konkursbo), which is managed for the creditors’ interest. One or more bankruptcy trustees (konkursförvaltare) are in charge of the assets.

The estate trustees ‘s sole responsibility is to administer the estate. The Enforcement Authority keeps an eye on the controller (Kronofogdemyndigheten).

Do you need help with debt collection in Sweden? We can help you get paid quickly and easily from your Swedish customers. Through local debt collection expertise in Sweden, we give you the best opportunity to get your money back. Contact us today or put our Swedish debt collection agency directly to work by uploading your unpaid invoice.

See how easy it is to get started with your case!