Debt Collection in Switzerland

- Risk-free. Pay only upon success.

- 9,5 % in commission.

- Debt collection conducted locally in Switzerland.

![]() An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh!

An international collection agency that is rated 9,4 out of 10 based on 72 reviews on Kiyoh! ![]()

Debt collection in Switzerland that is carried out by a national expert.

Are you waiting to be paid for a Swiss invoice? We can help you quickly and easily. By uploading the claim to us, a Swiss debt collection agency will immediately start working on your case. Read on to see how.

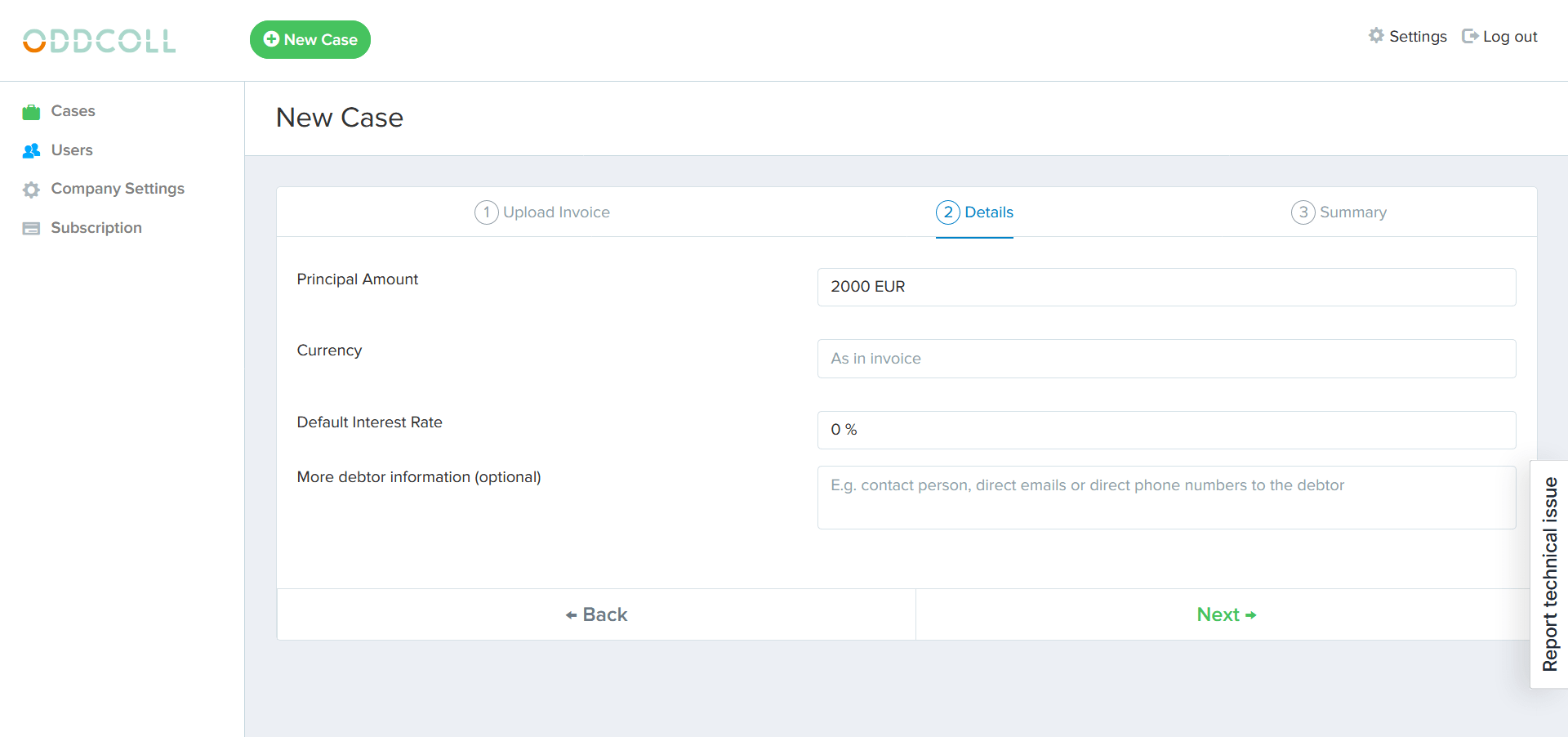

Three steps to get paid

Start your Swiss debt collection case by uploading your unpaid invoice to our debt collection platform.

Our local debt collection agency in Switzerland will start working on your case immediately.

As soon as the debtor pays, the money is transferred to you.

We maximize your chances of getting paid! And minimize your time spent.

Local debt collection expertise on the ground in Switzerland who know how to proceed specifically in Switzerland.

Completely risk-free debt collection. You pay nothing unless we make sure your debtor pays.

Handle your cases easily and quickly on our web portal.

Debt collection in Zürich

Understanding the unique financial landscape of Switzerland, such as Zürich and other major cities, local expertise to handle your debt recovery efficiently. Our dedicated team and intuitive platform ensure a smooth process, helping you recover debts swiftly while keeping you well-informed every step of the way. We prioritize maintaining positive relationships and protecting your reputation throughout the recovery process. With our comprehensive support, you can focus on your core business while we manage the complexities of debt collection.

Having unpaid invoices against customers abroad can be frustrating.

You may feel powerless when your customers abroad don’t pay your invoices. There is no way to put pressure on the debtor. But don’t despair. Oddcoll has solved this problem for international companies. We have created a debt collection platform that brings together the best debt collection agencies and law firms in countries around the world. That means you have local expertise available no matter where your clients are located. In concrete terms, this means that our quality-assured Swiss debt collection agency handles your cases against your Swiss clients. All you have to do is create an account and upload your unpaid invoice.

Our debt collection agency in Switzerland.

We are pleased to present, “LUCIANI GmbH – Büro für Inkassodienste”, our debt collection partner in Switzerland. A small debt collection agency whose strength lies in treating every customer and case with commitment and determination.

Describe your company briefly.

We are a small debt collection agency that handles all types of debt collection cases, mostly on credit from private individuals and companies.

What is your success rate in your debt collection cases in Switzerland?

Our success rate is between 50 and 100%. It depends on the outstanding claim.

How do you handle your cases?

We write the debtor letters and follow up with phone calls in order to reach a payment agreement with the debtor if he has not already paid the requested amount by then.

If you are taking legal actions in a case and you win in court, can the costs for legal actions that the client has paid for be added to the debt?

The costs depend on the amount in dispute and are determined by Swiss law. The costs ascertained by the court and that has been paid can be added to the debt. The amount always depends on the outcome of the proceedings. If we win 100%, we get 100%, if we win 50% we get 50%, etc.

“Judicial” debt collection in Switzerland.

Our local partner is an expert in debt collection in Switzerland and knows what measures and tactics are necessary to get a debtor to pay. Unfortunately, sometimes it may be necessary to take legal action against a debtor. Below is a brief summary of how the legal system in Switzerland is structured.

Overview of the legal system in Switzerland when you need to take your Swiss debt collection case to court.

Switzerland is a confederation of 26 cantons and half-cantons. The country is structured in three levels:

- The Federation (the federal state),

- the cantons, and

- the municipalities (local authorities).

The civil procedure is mainly regulated by the Swiss Code of Civil Procedure. (SCCP). The law came into force in 2011. This was a legislative effort aimed at harmonising the procedural laws in Switzerland, which were previously different and individual in each canton. However, much of the organisation of the judicial system is still left to the cantons. It is the cantons that are responsible for the first two instances of civil litigation and thus for legal debt collection in Switzerland.

The courts of first instance in a Canton are called district courts. Each canton has a second instance to which a party can appeal against the judgment of the first instance if it is not satisfied with it. In addition, these courts can act as a first instance for civil disputes where the amount of the claim exceeds CHF 100 000. However, the defendant’s consent is required to “skip” the first instance.

There is also a special court (Handelsgericht). A special commercial court that all Cantons can set up if they wish. In many commercial cases of an international nature, this is the competent court to turn to (if it is established in the Canton concerned.) However, the amount in dispute must be at least CHF 30,000.

Going to court with your Swiss debt collection case.

Step 1. Conciliation procedure.

In order to try to reach an agreement between the parties before the case goes to court, there are specific requirements for conciliation attempts under Swiss law. There is therefore at least one conciliation authority in each Canton. There are exceptions where parties do not have to go through the mandatory conciliation process. For debt collection cases in Switzerland, these are cases in the summary procedure, as well as cases in the commercial court.

The parties meet at the conciliation hearing and try to reach an agreement with each other. If one of the parties is from abroad, he or she may be represented by his or her lawyer at the hearing.

When the amount in dispute is less than CHF 2 000, the authority may actually choose to take a decision on the case (if the applicant so requests.) For cases involving amounts between CHF 2 000 and CHF 5 000, the authority may present a proposal to the parties as a constructive solution. The proposal will be converted into a judgment if no party objects to the proposal within 20 days.

If the parties agree in the negotiations, the agreement becomes as binding as a judicial decision. If the parties cannot agree, the creditor can take the case to court.

Step 2. Court proceedings.

The next step is to take the Swiss debt collection matter to court. There are then essentially three different court procedures available to the creditor.

Ordinary court proceedings:

The ordinary judicial procedure is used for monetary disputes where the claim exceeds CHF 30 000. The procedure is initiated by a writ of summons filed by the creditor, attaching the parties, the facts, the claim and evidence. The defendant then has the opportunity to submit a response to the application for a writ of summons. This is followed by a main oral hearing between the parties where they are allowed to present their arguments orally.

Simplified court proceedings:

There is a simplified procedure for disputes under CHF 30 000. These procedures are less formal than the ordinary procedures and allow the courts to take a more active role in guiding the negotiations.

The summary court procedure in Switzerland.

This process is available as an alternative in some cases and is intended to be even faster, simpler and cheaper than alternative procedures. The procedure is mainly intended to be applicable to cases that are not contested or that are very “simple” in nature. That is, where the legal position is very clear or where the facts can be easily proven by documents.

Other issues when taking a case to court.

When is a claim time-barred in Switzerland? The basic rule is that a claim in Switzerland is time-barred after 10 years. After that, the claim cannot be brought to court. (There are exceptions to this limitation period.)

Does a creditor need to be represented by a lawyer? No, there is no such requirement under Swiss law.

What language can be used in court? It depends on the language used in the Canton in question. In disputes where the claimant is from another country, the court usually accepts documents in English.

Enforcement of a claim in Switzerland.

In short, enforcement of a claim involves using the authorities to compulsorily transfer property from a debtor to a creditor.

Enforcement of monetary claims is governed by the DCBA. (The Debt Collection and Bankruptcy Act.) The Act regulates a procedure whereby a creditor’s claim is satisfied by realising a debtor’s assets and transferring them to the creditor, or alternatively by bankrupting the debtor and realising all the debtor’s assets for distribution to creditors.

The procedure is initiated by a creditor formally submitting an application for enforcement to the debt enforcement authorities. Usually at the place where the debtor has its registered office.

The debtor is notified of the application and is given twenty days to pay the claim or to contest the claim within ten days. If neither of these is done, the authority proceeds with the enforcement of the claim.

If the creditor has an enforcement order (such as a judgment from court proceedings), the creditor can ask the authorities to disregard the contestation of the claim. This is done by the creditor in the summary procedure in court.

We are happy to help you with debt collection in Switzerland. We have the local expertise to help you quickly and efficiently!

See how easy it is to get started with your case!